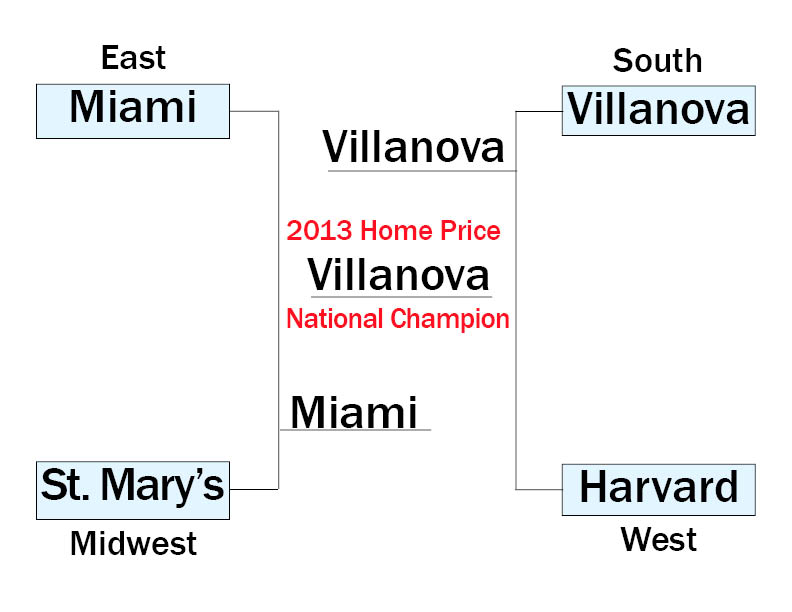

And at last we're at the Final Four!

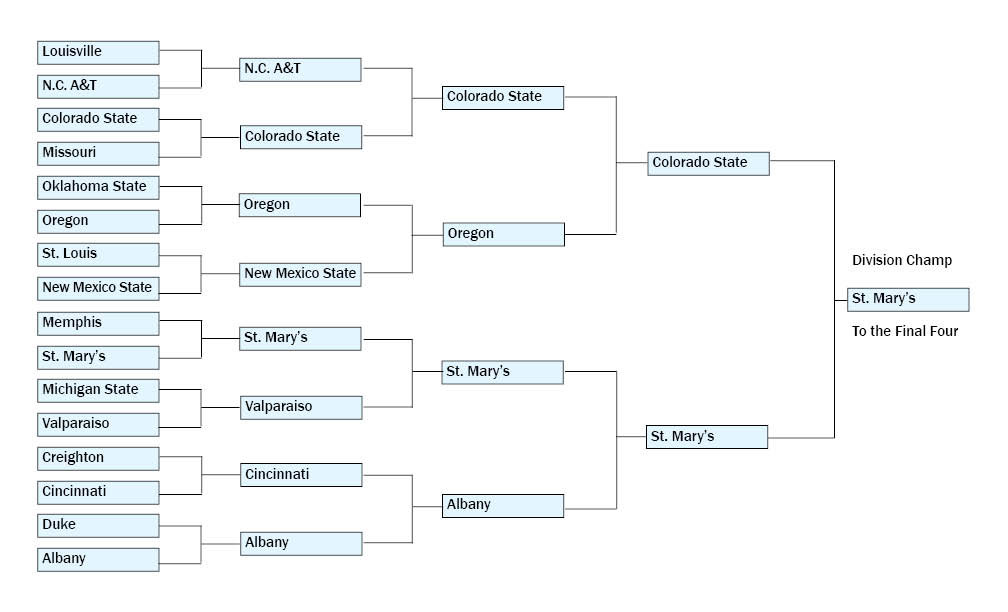

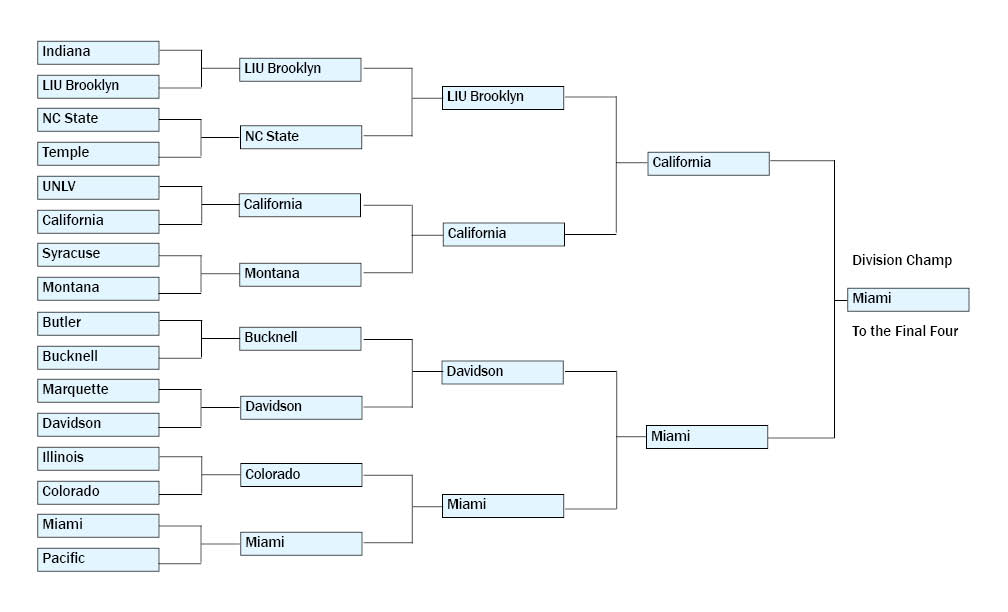

All four schools which made it to the Final Four had an impressive showing in terms of home price. The St. Mary Gaels (average home price: $1,071,735) and the Miami Hurricanes (average home price: $1,736,974) squared off in a heated matchup which ended with Miami advancing to the finals.

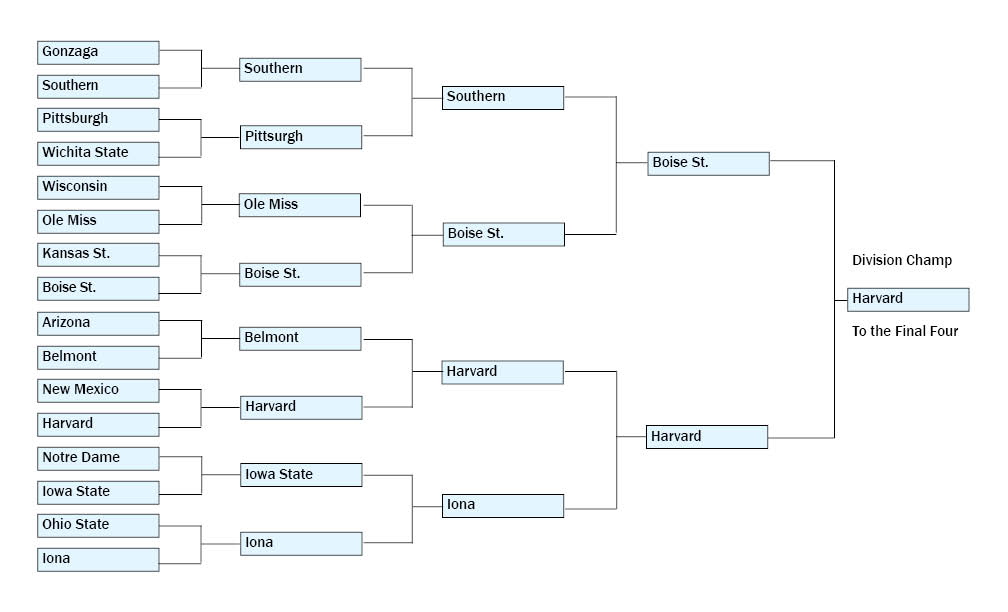

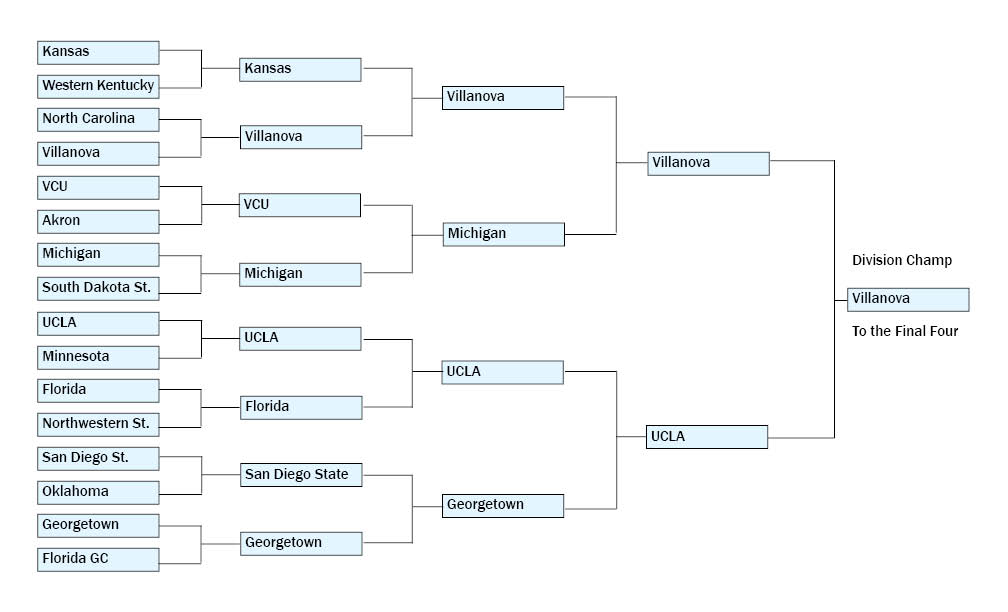

However, not even Coral Gables, the hometown of Miami University, could keep up with Villanova, PA. After sweeping Cambridge, MA in the semis, Villanova clinched the entire tournament with a home price of $2,407,805. The Wildcats benefited substantially from few key players including 770 Godfrey Rd., on the market for a mere $25 million, and 265 Abrahams Ln., with an asking price of $7,695,000.

We hope you had some fun with our March Madness brackets and get to watch some real March Madness in the coming weeks.

To see our first four March Madness brackets, click on the links below.

If you're looking for a Texas home loan (sorry 770 Godfrey Rd.) contact Georgetown Mortgage Bank today.

For many homeowners, the idea of paying off a mortgage early and owning a home without any debt is extremely satisfying. After all, it's one less bill to pay and could save you immensely on interest payments. But is paying off that debt really the best way to use your resources? Below we've listed a few things to consider before making an extra payment.

For many homeowners, the idea of paying off a mortgage early and owning a home without any debt is extremely satisfying. After all, it's one less bill to pay and could save you immensely on interest payments. But is paying off that debt really the best way to use your resources? Below we've listed a few things to consider before making an extra payment. Making an offer on a home can be a bit daunting, particularly if you're new to the home buying scene. To help you navigate the process, we've come up with a few questions you might want to ask the seller about the overall condition of the house.

Making an offer on a home can be a bit daunting, particularly if you're new to the home buying scene. To help you navigate the process, we've come up with a few questions you might want to ask the seller about the overall condition of the house. A short sale occurs when a lender allows a borrower to sell a property for less than the balance owed on a mortgage. For homebuyers, short sales can mean huge savings. However, there are some risks involved that house hunters considering a short sale should take into account.

A short sale occurs when a lender allows a borrower to sell a property for less than the balance owed on a mortgage. For homebuyers, short sales can mean huge savings. However, there are some risks involved that house hunters considering a short sale should take into account.